For the benefit of non-Venezuelan readers, some of our articles are translated into the English language. This is the page where you will found it. Should you need a translation of any other article, please make a comment in this page and we will contact you.

---------------------------------------------------------------------------------------------------

Introduction

Enforcement and Application

Change of IPC by INPC

Removal of Tax Inflation Adjustment for Certain Entities

Other Modifications

Implementing the Changes

Accounting Effects of the Reform Act of Venezuelan Income Tax Law

(Published in Spanish: December 8, 2014)

Introduction

By Decree No. 1.435 (Extraordinary Gazette No. 6.152) of November 18, 2014, was enacted the Reform Act of the Venezuelan Income Tax ("the Reform") resulting in limited effects for most entities and greater for certain other specifically identified entities.

This work aims to evaluate the accounting effects of the Reform with the warning that the author is not an expert in tax matters and that his interpretations and evaluations are based on his extended expertise as partner audit firm and certified public accountant in Venezuela. Other interpretations, evaluations and decisions might be made by other professionals according to the role they would be acting. Entities should consult their tax and accounting advisors before implementing any decision in connection with the Reform.

Enforcement and Application

For all purposes, the Reform became law on the date of its publication in the Official Gazette (November 18, 2014) and will apply to tax periods beginning after the publication date. Most Venezuelan entities have selected the calendar year as their accounting period; therefore, the first tax year affected by the Reform will start on January 1, 2015.

Some tax planning measures can be applied in 2014 to take advantages of changes introduced in the Reform. For these reasons, it is necessary that all entities should evaluate all its outcomes as soon as possible to implement the necessary and/or convenient changes before the end of 2014.

Change of IPC by INPC

An important amendment in the Reform is the substitution of the Consumer Price Index of the Metropolitan Area of Caracas (IPC in Spanish), for the National Consumer Price Index (INPC in Spanish), which will be the base for computation of tax inflation adjustment beginning in 2015. By changing the base, the entities will have to make all the calculations again because the INPC data is slightly different from the IPC data, and because there are no data of the INPC previous to December 31, 2007. However, it is anticipated that the Tax Administration will issue a provision ruling how the change should be implemented.

Getting ahead, my opinion is that Resolution No. 08-04-01 of the Central Bank of Venezuela (April 3, 2008), containing Rules for Application of the National Consumer Price Index (INPC), should be used. Second Transitory Clause of the Resolution provides for the following:

"Second Transitory Clause: Computations which, from the first official release of the data of the National Consumer Price Index (INPC), order or instruct laws, regulations, decrees, resolutions, rulings, circulars and other regulations or administrative acts of effects general, as well as court decisions, that have to be based on the price variation in periods whose starting date is before January 1st, 2008 and subsequent completion of that date, shall be made using the consumer price index of the Metropolitan Area of Caracas (IPC) until December 31, 2007, and from January 1st, 2008, the National Consumer Price Index (INPC), subject to the provisions of the first apart from Article 5 of this Resolution."

Therefore, all the affected entities must maintain calculations of tax inflation adjustment using the IPC data until December 31, 2007 and thereafter should have to recalculate all information using data from the INPC (January 1, 2008 onwards), resulting in slightly different amounts, since the IPC index is different from the INPC index. For example, at December 31, 2013, the INPC had an accumulated index of 498.10 while the IPC at the same date was 501.80.

I trust the process of changing the base for the calculations should not be very complex because, basically, what the entities will have to do is to replace the former index by the new one at year end 2015, and make computations with the new index. However, it is anticipated that some items of non-monetary assets (construction in progress, for example); tax exclusions from equity; and equity accounts must be computed applying the INPC data to the movements of these accounts, in order to achieve a reasonable result at year end 2015. Entities should move quickly to review the changes with their tax advisors to schedule the necessary work on time.

Accounting impacts of this change would affect the deferred tax asset that has been recognized by entities, as the new tax inflation adjustment amounts will differ from those in previous income tax returns. Additionally, the temporary difference resulting from the accounting inflation adjustment of non-monetary assets and the tax inflation adjustment of the same assets should likely be eliminated because all entities will compute both adjustments based on the INPC. The Reform would have the effect, to be recognized in 2015, of eliminating the temporary difference related to the inflation adjustment of non-monetary assets.

Change from IPC to INPC is reflected also in the Reform in all articles of the reformed law where IPC was designated as the tax base for many provisions. Therefore, applicants should consult the text of the Reform to know exactly all the modified articles.

Removal of Tax Inflation Adjustment for Certain Entities

The reform provides for the full elimination of tax inflation adjustment for bank, financial, insurance and reinsurance entities. For all purposes, the reporting date of these entities is December 31. Therefore, this change will have a full impact in 2015. This is a change unique for this group of entities. All the remaining entities will continue filing its tax returns with the tax inflation adjustment, with some restrictions.

Regardless of fiscal and/or economic reasons for this change and the fact that it concerns only a limited number of entities, it is important to know its accounting effects, if any exist.

All entities affected by this change must apply specific accounting standards provided by relevant regulatory bodies: Superintendence of Banks or Superintendence of Insurance Companies. The first institution permits the recognition of deferred tax asset or liability on a basis slightly different to than set out in IFRS. The Superintendence of Insurance does not permit the recognition of any deferred tax asset or liability. However, it is clear that all these entities have temporary differences as a result of the tax inflation adjustment of non-monetary assets and the recognition of other transactions, as happens with all other entities reporting under IFRS (Full IFRS or IFRS for SMEs). These temporary differences give raise to a deferred tax asset or liability, only recognized by banks and other financial institutions but not by insurance and reinsurance entities.

The sources of temporary differences in the financial statements of all these entities come from: inflation adjustment of non-monetary assets; other transactions and some temporary differences arisen when income or expense is included in accounting profit in one period but is included in taxable profit in a different period (described as timing differences). As it was said, only banks and financial entities have recognized a deferred tax asset or liability for these temporary differences. Insurance and reinsurance entities did not recognize any deferred tax asset or liability, which causes a distortion in its financial statements.

Upon the enactment of the Reform, banks and other financial entities must derecognize any deferred tax asset or liability for inflation adjustment of non-monetary assets. However, these entities should wait until the Tax Administration publishes the necessary regulations on this subject.

Foreign insurance and reinsurance entities reporting abroad will be impacted by the elimination of the tax inflation adjustment because it is possible that in their translated financial statements it has been recognized the deferred tax asset or liability for all temporary differences. By eliminating the tax inflation adjustment, the related temporary difference disappears forcing an adjustment of the deferred tax asset, probably insignificant. Perhaps it is convenient that these entities derecognize that asset before the 2014 reporting date, not waiting until 2015, but any decision would have to be consulted with the auditors and the parent company. Also, these entities should wait until the Tax Administration publishes the necessary regulations on this subject.

Other Modifications

Based on the modified articles, we will review other changes (but not all of them) and their accounting impacts. Some of these modifications have no a direct accounting effect:

Article 27, Numeral 6:

Current text follows:

Article 27 – To obtain the taxable income, the following deductions can be made, which, unless otherwise specified, shall correspond to incurred expenses, not attributable to cost, and must be normal, necessary and incurred in the country to produce the taxable income....... ..

6: Losses of goods intervening in the production of income, not paid by insurance or alternative compensation, when such losses are not attributable to cost.

The Reform now says:

"6. Losses of fix assets (property, plant and equipment) used in the production of income" eliminating the generic term "goods intervening in the production of income.”

Interpreting the change, it can be concluded that provisions and/or accruals previously recorded as estimation for losses on assets not attributable to the cost, other than inventories and fixed assets, could not be deducted in tax returns beginning in 2015. Entities could only recover provisions declared in previous years (as they were not deductible for tax purposes), by applying it to the assets, adjusting the related deferred tax asset.

This action could be completed in 2014, if entities can legally support the asset derecognition and use of the provision in its financial statements.

Additionally, the Reform added a new paragraph to Article 27, the Nineteenth, which say:

"Paragraph Nineteenth - Deduction of losses from derecognition of inventory or assets held for sale shall not be permitted; neither losses from fix asset used in the production of income, when they do not comply with the conditions in numeral six of this Article."

These conditions refer to losses due to accident or force majeure, not compensated by insurance or other alternative compensation, provided that such losses are not attributable to cost.

Affected entities should consult their tax advisors on this modification to properly apply the changes to tax returns of 2014 and 2015, but should also consult their auditors and/or accounting advisors to determine the right course of action in this and other changes as a result of the Reform.

Article 55:

Current Article 55 said:

“It is authorized the carryforward of net operating losses not compensated up until three (3) years subsequent to the year in which they had been declared. The Reglamento will establish the rules of procedure applicable to losses of the year and previous years.”

The Reform now states:

"Article 55 - Net operating losses from Venezuelan source may be carryforward to taxable income of similar source, provided that such income is obtained within three (3) subsequent tax periods to that when the losses occurred, and that amount does not exceed in each period 25% of the taxable income.

Losses from foreign source can only be carryforward to taxable income of similar source, in the same terms set forth in the heading of this Article.

The Reglamento will establish the rules of procedure applicable to instances of losses of the year and previous years. "

Article 183:

Current Article 183 said:

“Net losses from not compensated tax inflation adjustment will only be carried forward for one period.”

Now, this article says:

"Article 183: Net losses from not compensated tax inflation adjustment cannot be carried forward."

Amendments to Articles 55 and 183, in combination, have several effects, as follows.

First, carryforward of losses from tax inflation adjustment will be not permitted and entities will no longer deduct it subsequently to 2015. Losses of the same origin declared in 2013 can be only carried forward to 2014. Therefore, entities recognizing deferred tax asset for these losses should be derecognized it in 2014 regardless of whether the entity uses the losses or not.

Second, there is an important change in Article 55 because the entity may only use the tax loss carryforward up to 25% of taxable income. To understand this change, see the following Case of Study:

This is our interpretation of Article 55. In the example it can be observed that the entity cannot use tax losses for a total of Bs87.500, due mainly to the cap established in the Reform. Tax losses can be only be used up to 25% of the taxable income, provided that they are not expired. The biggest the taxable income is, the maximum the tax loss carryforward can be used.

The example shows how the 2012 tax loss is fully used in 2013 (Bs37.500) and 2015 (Bs62.500), because it had not expire and did not exceed the 25% cap. On the contrary, the 2014 tax loss was partially used in 2015 (Bs12.500), 2016 (Bs25.000) and 2017 (Bs75.000), which were the cap for both years. Bs87.500 of the tax loss of 2014 could not be used.

The example may be more complex or more basic, as desired. Therefore, each affected entity must perform their own calculations to plan (if it is possible) how could use the maximum of the declared tax losses.

A new Regulation of the Tax Administration is necessary to implement the modification, but in any event there is a significant accounting effect for entities that have included its tax losses in the computation of the deferred tax asset. As now there is a limitation to use such losses, it is no sure that an entity could apply it at 100%. If it was recognized a deferred tax asset on these losses, perhaps it is best to write it off and reveal the fact in the notes to the financial statements. Any action should be discussed with the auditors and tax advisors.

Article 14, Numeral 10:

This numeral, which was removed, encompassed the following provision:

“Article 14: Exempt from income tax are: ......

10 Entities devoted exclusively to cultural, religious, artistic, scientific, conservation, protection and improvement of the environment, technology, sports, professional and trade associations, provided that they are not-for-profit entities, for the taxable income obtained as a means to its purposes, that in no case distribute gains, dividends of any kind or any part of its net assets to founders, partners or members of any nature. Similarly, under the same conditions, academic and educational entities, for the taxable income obtained when providing services within the general conditions set by the National Executive.”

Basically the removal of Numeral 10 affects many entities, among which are included: non-governmental entities, not-for-profit clubs, sports and recreation associations, foundations, non-profit organizations dedicated to the promotion of culture and sport, and many others that can be easily identified between the large group of entities that have not for profit purposes.

The implications for entities not enjoy tax exemption from 2015 will have to be evaluated quickly so that their management complete the necessary steps to include them, if that were possible, as part of the organizations in Numeral 3 of Article 14, which was not changed nor deleted, and which states:

3. Charitable and social welfare entities, provided that their income is obtained as a means to achieve the above referred purposes; that in any case distribute gains, profits of any kind or any part of its assets to its founders, partners or members and does not make payments by way of profit sharing or distributing its equity.

Article 86:

In the Reform the wording of this article was simplified. This article is referred to the designation of withholding agents and simply authorizes that by a general regulation these agents and percentages to withhold taxes be regulated. All paragraphs of the reformed law were also eliminated.

Additionally a new Article 198 was added to complement Article 86:

"Until the Tax Administration deliver the regulation mentioned in Article 86, all entities shall continue to applying the provisions of Decree No. 1.808 of April 23, 1997, published in the Official Gazette of the Bolivarian Republic of Venezuela No. 36.203."

Decree 1.808 refers to the current withholding regulations applied since 1997. Changes can be made in definitions, withholding rates, procedures for documenting and pay withheld taxes, etc.

Therefore, all entities should be aware of the promulgation of the new instrument on withholding income taxes to adapt their internal controls and procedures to comply with formal duties to be provided in the future.

Implementing the Changes

Entities must apply all changes beginning on or after January 1st, 2015, depending on its reporting period. Except for tax planning measures applied in 2014 (as recommended), the effects of the Reform must be recognized beginning in the 2015 tax returns and financial statements.

Those entities aiming to apply tax planning measures in 2014 should discuss it with their auditors and tax advisors in order to arrange the recognition procedures and disclosures that would be required.

Original Text of the Reform (in Spanish Language)

Those interested in consulting the content of the Reform and the reformed law can obtain it in the repository of information of this Blog in Google Drive. Please, click this link

Introduction

A popular idiom says: “You can’t see the forest for the trees.”

That phrase might apply to those interested in the financial information of Venezuelan entities, but particularly shareholders, managers, controllers, accountants and especially auditors and sole practitioners CPAs.

I mean the fact that watching what is happening in Venezuela from abroad, some observers and researchers of economic activity and country´s businesses, see "a forest of problems" affecting nearly all business entities, but undoubtedly many who live in the country do not detect it or lose sight of the problems, and surrounded by the problems as they are, fail to perceive and evaluate them accurate and timely.

Situations such as the shortage of foreign exchange needed for most activities; continuing increases in prices, labor and general expenses; controls established by government authorities to keep prices at levels they want; the absence of a real market where products and goods are traded freely; and many other uncertainties generally affecting all entrepreneurs, are part of the "forest of problems". But many who observe and assess concerned, focusing on finding solutions, can’t see the whole situation because they are looking too closely at the details.

Most probably, many actors in the business activities that have been or are being affected by these problems, individually or jointly, are dedicated to finding solutions and often are confronted with the reality that these solutions neither do not exist nor are possible in the current non-viable environment. Then, they have no choice but to wait a while and see if it resolves itself, someday, because they have no way to afford a solution.

As this lack of activity occurs, the actors don’t see the forest and as a consequence they don’t realize that exists a fundamental problem affecting many organizations, but the fact is that some are coming to the conclusion (or have reach, in many cases) that the reality seems to be indicating that their businesses are no longer viable; that they are no longer feasible; that no longer have continuity because there are no short-term solutions and much less medium or long-term solutions. Those who come to this conclusion suddenly realize that their business is no longer financially feasible; that theirs is not “a going concern business"; that there is a strong likelihood that the “Going Concern Assumption”, as outlined in accounting principles, must be evaluated urgently. Is in this moment when those actors begin to see "the forest" and no longer see just the trees.

This work is not to explore or provide solutions to the "forest of problems". Instead, it is intended to guide all of who are potentially involved in the assessment of this severe problem and how to approach it from the accounting point of view. That is the purpose of this single contribution to the Venezuelan CPA profession.

Many times, the preparation of financial statements in accordance with International Financial Reporting Standards (IFRS) is an automated process which is completed almost without taking into account that there are certain rules that must be evaluated every time when the reporting entity submit its financial statements to stakeholders. When preparing financial statements in accordance with IFRS (and US-GAAP), management must assess the ability of the entity to continue as a going concern. IAS 1 Presentation of Financial Statements and Section 3 of IFRS for SMEs contain provisions in regard to this matter.

Accounting Assesment

Financial statements are always prepared under the going concern assumption unless management has decided to put the entity in liquidation or stop business operations. It is presumed that an entity is always in operation and will remain so until management, shareholders, a government entity, or an unforeseen event determine the cessation of its business. That's what normally happens. But on occasions, internal or external factors may evidence, whether managers or owners have raised it, that the entity could not continue in operation because it does not meet all the needed conditions to accomplish its business objective.

Under IFRS, when assessing whether the going concern assumption is appropriate, management must take into account all available information about the future, which must cover at least twelve (12) months from the end of the current reporting period. An entity closing in December should consider this information for the next twelve months, i.e. until December of the following year. The degree of detail of the future considerations depends on the facts in each case.

If an entity has a history of profitable operations and ready access to financial resources, it can be concluded that the application of the going concern assumption is appropriate, without having to perform a detailed analysis. However, the standard does not define what “financial resources” are. The same concept is used in International Standard on Auditing (ISA) No. 570, "Going Concern" without further explanation.

IAS 1 requires that an entity shall disclose information about the assumptions it makes about the future, and other major sources of estimation uncertainty at the end of the reporting period, that have a significant risk of resulting in a material adjustment to the carrying amounts of assets and liabilities within the next financial year. This is a very important concept, because if an entity is not a going concern business, it should present its assets and liabilities on the liquidation basis.

The Standard states that the determination of the carrying amount of assets and liabilities requires estimation, at the end of the reporting period, about the effects of uncertain future events on these amounts. For example, in the absence of recently observed fair market prices, it would be necessary to make estimates about the future to measure the recoverable amount of classes of property, plant and equipment; the effect of technological obsolescence or other issues on inventories; provisions subject to the future outcome of litigation in progress; liabilities and employee benefits in the long term, such as pension obligations, if present.

In US GAAP similar standards are in Subtopic 205-40 Going Concern. In this regard, FASB recently issued ASU No. 2014-15 Bulletin containing the accounting principles on this matter which are very similar to those set out in IFRS.

Audit Assesment

As mentioned, ISA 570 contains the rules for the work to be performed by the external auditor when reviewing the financial statements of an entity to render an opinion on these financial statements based on International Standards on Auditing.

In Venezuela auditors must apply those rules in accordance with that approved by the Federation of Public Accountants of Venezuela (FCCPV). See the relevant information, in Spanish: https://sites.google.com/site/fccpvauditoria/noticias/basesyfundamentos.

ISA 570 includes similar accounting standards and provisions already mentioned and specifically states in paragraph 7 that:

"Evaluating management going concern assumption involves making a judgment, at a particular point in time, about the future outcome of events or conditions that are inherently uncertain. The following factors are relevant:

• In general, the degree of uncertainty associated with the outcome of an event or condition increases significantly the more I advance into the future is the judgment made on the outcome of an event or condition. For that reason, most financial reporting frameworks requiring an explicit management assessment specify the period for which management is required to take into account all available information.

• Any judgment about the future is based on information available at the time the judgment is made. Subsequent events can contradict a judgment which was reasonable at the time it was made.

• The size and complexity of the entity, the nature and condition of its business and the degree to which it is affected by external factors, all this affects judgment regarding the outcome of events or conditions."

A non-exhaustive list of examples of events or conditions that individually or collectively may cast significant doubt about the going concern assumption is included in paragraph 8 of ISA 570. See the next section.

Assesment of the Venezuelan Circumstances

To assess the situation in Venezuela, managers and/or shareholders must take into consideration the concepts of IAS 1 and the disclosures required in this regard (or Section 3 of IFRS for SMEs if it is a medium or small entity).

In order to guide readers on the factors that may indicate a going concern in their businesses, following is the contents of paragraph 8 of ISA 570:

“The following are examples of events or conditions that, individually or collectively, may cast significant doubt about the going concern assumption. This listing is not all-inclusive nor does the existence of one or more of the items always signify that a material uncertainty exists.

Financial

• Net liability or net current liability position.

• Fixed-term borrowings approaching maturity without realistic prospects of renewal or repayment; or excessive reliance on short-term borrowings to finance long-term assets.

• Indications of withdrawal of financial support by creditors.

• Negative operating cash flows indicated by historical or prospective financial statements.

• Adverse key financial ratios.

• Substantial operating losses or significant deterioration in the value of assets used to generate cash flows.

• Arrears or discontinuance of dividends.

• Inability to pay creditors on due dates.

• Inability to comply with the terms of loan agreements.

• Change from credit to cash-on-delivery transactions with suppliers.

• Inability to obtain financing for essential new product development or other essential investments.

Operating

• Management intentions to liquidate the entity or to cease operations.

• Loss of key management without replacement.

• Loss of a major market, key customer(s), franchise, license, or principal supplier(s).

• Labor difficulties.

• Shortages of important supplies.

• Emergence of a highly successful competitor.

Other

• Non-compliance with capital or other statutory requirements.

• Pending legal or regulatory proceedings against the entity that may, if successful, result in claims that the entity is unlikely to be able to satisfy.

• Changes in law or regulation or government policy expected to adversely affect the entity.

• Uninsured or underinsured catastrophes when they occur.

The significance of such events or conditions often can be mitigated by other factors. For example, the effect of an entity being unable to make its normal debt repayments may be counter-balanced by management’s plans to maintain adequate cash flows by alternative means, such as by disposing of assets, rescheduling loan repayments, or obtaining additional capital. Similarly, the loss of a principal supplier may be mitigated by the availability of a suitable alternative source of supply.”

Additionally, as mentioned earlier, IAS 1 states that if an entity has a history of profitable operations and ready access to financial resources, it can be concluded that the application of the going concern assumption is appropriate without having to perform a detailed analysis.

Therefore, an analysis of what the term "financial resources" would mean, apply. A broad definition of “financial resources” includes the net financial assets of an entity that have some degree of liquidity. Cash, accounts and notes receivable, deposits with financial institutions, foreign exchange and equity and bond holdings are part of the financial resources, net of financial liabilities.

Within the Venezuelan business environment, it is my opinion that foreign currency are, per se, the main financial resource of many entities and comprise its principal financial objective, because these entities are facing a continued difficulty to get foreign currency in a country that maintains a tight exchange control since 2003. Financial resources in local currency seem to abound at relatively low interest rates (compared to current rates of inflation) and this issue could be considered a mitigating internal factor.

Perhaps, many entities, especially large entities exploiting high revenue businesses, have big levels of cash in banks and accounts receivable in local currency, but with many are in trouble to convert it into foreign currency. It is known that many large multinationals have failed to pay dividends to its shareholders from abroad due to the difficulty in obtaining foreign exchange, although they have reported large amounts of net earnings in local currency. Working on a business model based only in local transactions, these entities would have no difficulty in continuing to operate without foreign currency. However, managers of these entities are struggling to get foreign currency to accomplish the process for assets replacement; payment of royalties and dividends; or for other purposes, which is not guaranteed by national government.

Other not so large entities may own financial resources in local currency but as they cannot be converted into foreign exchange for imports of goods and services or for payment of outstanding debt in foreign currency, are prevented from continuing its regular operations, perhaps for long periods during which they have to continue paying salaries, social charges and expenses of any kind, without the possibility of generating revenue because they don’t have inventory or because certain equipment or machinery for the production have being halted waiting for inputs or parts from abroad.

In addition to the issue of foreign currency, which is the main issue in Venezuela today, a set of situations require management entities and their auditors to review for evaluating the going concern assumption, such as:

1. Inflexible government controls on prices that undermine the ability of the entity to decide on the pricing of their products or services, with the consequent possibility of incurring losses from continuing operations.

2. Risk of devaluation of the national currency which permanently boost local price increases. New exchange rates signify increases in price of products and services. In an unending process to justify prices within the framework of price control´s law, entities would incur in more operating losses while new prices are approved by governmental authorities.

3. Exacerbated inflation causing similar effects to the above, because increases in costs are not easy translated to prices of goods and services because of the price controls.

4. Excessive and complicated legal framework that requires entities to disburse amounts for the payment of employee benefits, taxes and legal contributions of all kinds, without any connection with the operation of the entity. That is, entities must make those payments, whether they are not producing at full capacity or are not recovering the costs of its goods and services.

5. Risk of prolonged closures of plants and warehouses if government authorities decide that the entity has violated certain laws, for example the mentioned Law of Fair Prices.

6. Difficult to import essential supplies and goods and services for own production due to the inability to obtain foreign currency for imports.

7. Difficulty obtaining local goods and supplies necessary for the production itself, because other producers or importers in the country face the same problems of production and/or importation, all contributing to high level of shortages of many goods and supplies.

8. Risk of recording continued losses for the buildup of financial and production problems; untimely labor strikes without reason or justification; arbitrary plant and warehouses occupations by workers with or without justified reasons; sales diminished with excessive costs and expenses increased for the reasons previously discussed.

9. Inability to pay debts in foreign currency due to the failure to obtain foreign exchange through legal mechanisms of exchange and risk of incurring in violations of laws created to prohibit acquisition of foreign currency out of these mechanisms.

10. Risk (although not as significant) of expropriation of all kinds of assets due to unforeseen or unanticipated government decisions.

11. Loss of key management, production and marketing personnel as a result of emigration of qualified professionals to other countries.

12. Seizure of products by actions of governmental authorities based on the framework of laws such as the Law of Fair Prices.

13. Risk of losses in accounts receivable from entities that, in turn, would be having trouble going concern assumption.

14. Depressed real estate prices caused by the atmosphere of general uncertainty about the assets in the country; and

15. Other minor.

Analyzing these factors and others discussed above in an individualized context, it could be concluded that an entity would not face problems on its status as a going concern, but if somebody combine several of them and the test results are negative, he could reach to a different conclusion.

Therefore, permanently and full evaluations must be completed by management and shareholders (and external auditors, if applicable). In case an entity concludes negatively in its analysis, the going concern assumption could be impaired.

Consequences of the Analysis

The accumulation of some of the matters discussed in the previous section doesn’t necessarily determine that an institution faces difficulties to ensure compliance with the Going Concern Assumption. New business decisions; changes in government policies and laws; improved economic outlook; change of line of business; change of management approach; etc., can be used as a mean to justify that the entity must, yet, be considered as a going concern, even though financial reports could show severe financial problems. In such cases, the disclosures required by IFRS would help users of financial statements of these entities to understand the situation, which imply a good preparation of management to properly develop such disclosures.

However, if the conclusions from the analysis are that the entity is facing severe business problems that would build up in the immediate future; i.e. the continuity of the entity would be under a certain level of uncertainty about their future, management must obtain specialized audit and legal advice to properly proceed before reporting.

IFRS does not contain any provision for the presentation of financial statements under a basis for liquidation of a company with going concern problems. A guide for those interested in improving their knowledge on such an accounting basis, can found it in the Subtopic 205.30 US GAAP Presentation of Financial Statements - Liquidation Basis of Accounting.

Conclusion

We can only see the forest when we get out of the trees!

--------------------------------------------------------------------------------------------------------------------------

This is a translation of the original work in the Spanish language titled "Hipótesis de Negocio en Marcha" published in this Blog in September 26, 2014.

--------------------------------------------------------------------------------------------------------------------------

Translation Losses in Venezuela (Published May 29, 2014)

General Background

News published in Venezuelan and international media, have informed that subsidiaries of transnational entities have reported foreign currency losses when their financial statements are to be consolidated into the financial statements of the parent company, due to the intricate and complicated exchange rate system now in force. Information is confusing, but the most common news refers to the reporting of losses due to the application of different exchange rates in comparison with the former official CADIVI rate.

Details of some of the news published by private media address these issues while showing different patterns (no particular order or relevance with respect to copying and omitted details of the story that are not relevant to this work):

News 1:

Coca Cola announced that, based on recent changes in the Venezuelan exchange devices: “We changed the exchange rate used to prepare the financial statements of our Venezuelan subsidiary into U.S. dollars."

They explained that from March 28, 2014, the company will be using the Supplementary System Administration of Foreign Exchange # 1 (SICAD I).

Coca Cola declared that during the first quarter, the Company recorded US$247 million on charges related to the devaluation of the bolivar and by using current projections the Company anticipates that the modification of the exchange rates will impact its profit adversely for the rest of 2014. Besides,... (Reported by Business Insider Website).

News 2:

Brink´s, the parent company of Servicio Pan Americano de Protección, announced it would reduce the value of its assets in Venezuela, causing a 12% stock drop in the New York Stock Exchange.

Brink´s decision may indicate similar action by DirecTV and MercadoLibre, companies with big amounts of money trapped in Venezuela, because the modification of the exchange rate to SICAD II (about Bs50 per US dollar) would diminish the income, said co-founder of hedge fund Newfoundland Capital Management, Jonathan Rosenthal. ”Now is crystal clear for bankers that those businesses will not create the same amount of cash as they thought,” said Rosenthal, whose hedge fund is based in the Cayman Islands....

Bloomberg noted that Brink´s is the first company to adopt the SICAD II exchange rate for its first quarter earnings. ”Meanwhile, Procter & Gamble, Colgate-Palmolive and Telefonica have said they will adopt SICAD I, created last year for the imports of non-essential items” they said.

News 3:

DirecTV and MercadoLibre are prepared to remeasure their accounts with the exchange rate SICAD II, so that their profits in Venezuela could drop up to 50%.

The satellite operator DirecTV could see their cash holdings reduced by 26% while earning per share would decline between 9% and 11% if measured at Bs50 per dollar, said the co-founder of hedge fund Newfoundland Capital Management.

"There are U. S. companies where any income between 10-50% can disappear even though Venezuela is totally off the radar,” he said. His hedge fund "is looking for ways to monetize this” which includes betting on the decline in DirecTV, he added.

MercadoLibre should reduce its operating income by 31% if remeasures its assets in Venezuela using the rate of SICAD II, according to data compiled by Bloomberg.

Reuven Yaron, President Reuven Capital Investments LP, said they are betting that the shares of the company will be reduced. ”These companies reported fictitious profits and soon they´ll start to really report losses. Those bolivars are useless”, he said.

News 4:

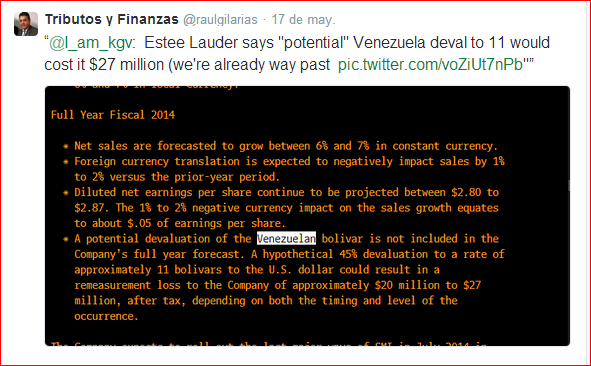

In this example, Estee Lauder has not recognized any loss, although, according to the news, a ”hypothetical devaluation of 45%” could induce a remeasurement of the results causing a loss of between US$20 and US$27 million after tax, depending on the timing and size of the devaluation.

In short, to sum things up, that news reflects the drama currently faced by multinational companies with Venezuelan subsidiaries. The worst thing about the situation is the chaotic way the companies are performing. It is observed that in some cases it was announced that certain entities decided to apply the exchange rate SICAD I for the translation of its financial statements; others commented that they are considering the exchange rate SICAD II; and another announced it will continue using the preferential rate CENCOEX (old CADIVI), since it assumes that there is no official devaluation in Venezuela.

At first glance, a reckless reader without accounting knowledge would not understands how the same problem can be treated in various ways, as if there were not accounting principles and rules to address this matter. The truth is these rules and/or principles do exist, but to apply them is necessary to implement an extreme use of judgment and careful application of professional standards, as well as deep knowledge of the economic and financial situation happening in Venezuela at the present time.

Technical Background

The issue is relatively simple, but is somehow complex for the manner certain events have developed in Venezuela in recent times. Some of the questions any unqualified person without accounting knowledge would made are: 1) Why does these companies lose money if they have a good performance in Venezuela and make so much money?; 2) Is it not true that the national government is forcing a control of prices because these companies and many others are selling at exorbitant prices and are producing large profits for their shareholders?; 3) How the SICAD and/or the CADIVI exchange rate affects these matters?

An accountant with experience in reporting to the parent company of his Venezuelan employer perfectly knows the answers: 1) Many transnational (and national) corporations earn money, but their results are measured in local currency, in Venezuelan bolivars; 2) Prices are based, mainly, on imported goods and raw materials and companies has to pay it in foreign currency; 3) The foreign exchange rate, whichever the company uses, is used to account for foreign currency transactions in the Venezuelan books and for translation of the financial statements for purposes of consolidation into the financial statements of the parent company.

Companies quoted in previous section, generally correspond to USA entities and only one is a European corporation. All of them have the same problem. The USA entities should manage it applying the US GAAP; Europeans using the IFRS. Generally, Asian companies, Latin American and entities of other regions are using IFRS. Starting from this distribution, a comparative approach could be framed. The next table shows the main elements of the accounting rules which should be evaluated (and were probably used) by these entities:

Comparative Table

#

|

Accounting Standard / Principle / Guide

|

Under IFRS

|

Under US GAAP

|

1

|

Venezuela is considered a hyperinflationary economy[1]

|

Yes

|

Yes

|

2

|

The functional currency is the Venezuelan bolivar [2]

|

Yes

|

Yes

|

3

|

Transactions in foreign currency are recognized at the exchange rate of the market or another representative transaction rate[3]

|

Yes

|

Yes

|

4

|

Financial statements are translated into the reporting currency

|

Yes

|

Yes

|

5

|

The reporting currency, when it relates to an entity located in a hyperinflationary economy, is the currency of the parent company

|

Yes

|

Yes

|

6

|

Financial statements of the entity must be remeasured before they are translated into the reporting currency[4]

|

Yes

|

Yes

|

7

|

Translation of the financial statements is performed using the exchange rate of >>>>>>>[5]

|

???

|

???

|

8

|

Translation results are recognized in income of the period

|

Yes

|

Yes

|

Point 7 concentrates the problems foreign entities are facing. I will try to summarize the origin of the differences between companies. However, there are other issues related to the management of foreign currency transactions that would cause additional losses to national entities, which will not be discussed in this article. For more details, read the article quoted at the start of the Foreign Exchange Background Section below.

Analysis under IFRS

IAS 21 ”The Effects of Changes in Foreign Exchange Rates” contains the requirements that a company must complete to translate its financial statements into a foreign currency when the entity is located in a hyperinflationary economy, which is the case of Venezuela. The following paragraphs are a true excerpt from the original text of IAS 21 (underlines are mine):

Definition

8 The following terms are used in this Standard with the meanings specified:

• Closing rate is the spot exchange rate at the end of the reporting period.

......

• Spot exchange rate is the exchange rate for immediate delivery.

Translation to the presentation currency

38 An entity may present its financial statements in any currency (or currencies). If the presentation currency differs from the entity’s functional currency, it translates its results and financial position into the presentation currency. For example...

42 The results and financial position of an entity whose functional currency is the currency of a hyperinflationary economy shall be translated into a different presentation currency using the following procedures:

(a) All amounts (i.e. assets, liabilities, equity items, income and expenses, including comparatives) shall be translated at the closing rate at the date of the most recent statement of financial position, except that...

43 When an entity’s functional currency is the currency of a hyperinflationary economy, the entity shall restate its financial statements in accordance with IAS 29 before applying the translation method set out in paragraph 42, except for comparative amounts.....

Text above copied is summarized in the Comparative Table. Therefore, it only remains to determine the exchange rate to be applied in Venezuela as under IAS 21, because that's where the problem originates. IAS 21 was the result of a thorough review of the rule and others that existed before its enactment in 1993. Reproduced definitions should solve the problem but this is not possible due to the situation discussed in Foreign Exchange Issues section.

Analysis under US GAAP

Section 830 "Foreign Currency Matters” basically contains all the elements for an entity to translate its financial statements into a foreign currency. Copied below are some paragraphs which will orient the reader to understand what sets this body of rules, which basically is the same as set out in IFRS, with certain minor differences. Underlines are mine:

830-10-45 Other Presentation Matters

General

45-1 The guidance in this Section relates to how a reporting entity determines the functional currency of a foreign entity (including of a foreign entity in a highly inflationary economy), remeasures the books of record (if necessary), and characterizes transaction gains and losses. The guidance is organized as follows:

· The functional currency

· The functional currency in highly inflationary economies

· Remeasurement of books of record into the functional currency

· Transaction gains and losses not extraordinary.

The Functional Currency in Highly Inflationary Economies

45-11 The financial statements of a foreign entity in a highly inflationary economy shall be remeasured as if the functional currency were the reporting currency. Accordingly, the financial statements of those entities shall be remeasured into the reporting currency according to the requirements of paragraph 830-10-45-17. For the purposes of this requirement, a highly inflationary economy is one that has cumulative inflation of approximately 100 percent or more over a 3-year period.

Remeasurement of the Books of Record into the Functional Currency

45-17 If an entity’s books of record are not maintained in its functional currency, remeasurement into the functional currency is required. That remeasurement is required before translation into the reporting currency. If a foreign entity’s functional currency is the reporting currency, remeasurement into the reporting currency obviates translation..…The remeasurement process is intended to produce the same result as if the entity’s books of record had been maintained in the functional currency. To accomplish that result, it is necessary to use historical exchange rates between the functional currency and another currency in the remeasurement process for certain accounts (the current rate will be used for all others), and this guidance identifies those accounts. To accomplish that result, it is also necessary to recognize currently in income all exchange gains and losses from remeasurement of monetary assets and liabilities that are not denominated in the functional currency (for example, assets and liabilities that are not denominated in dollars if the dollar is the functional currency).

830-30-45 Other Presentation Matters

General

45-1 The guidance in this Section discusses how a reporting entity translates foreign currency statements and analyzes changes in the cumulative translation adjustment. It also addresses two related reporting matters.

Translation Using Current Exchange Rate

45-3 All elements of financial statements shall be translated by using a current exchange rate as follows:

a. For assets and liabilities, the exchange rate at the balance sheet date shall be used.

b. For revenues, expenses, gains, and losses, the exchange rate at the dates on which those elements are recognized shall be used.

45-4 For purposes of translation of financial statements referred to in this Subtopic, the current exchange rate is the rate as of the end of the period covered by the financial statements or as of the dates of recognition in those statements in the case of revenues, expenses, gains, and losses.

45-6 In the absence of unusual circumstances, the exchange rate applicable to conversion of a currency for purposes of dividend remittances shall be used to translate foreign currency statements.

Analyzing the preceding paragraphs, it is observed that coincide quite closely with the transcripts of IAS 21, although US GAAP’s are more specific than IFRS. In that regard, paragraph 45.6 provides for the possibility of using a special, designated exchange rate: the dividend rate, which is not taken into account by IFRS. That has led to the great diversity of positions elected by entities required to report under US GAAP and possibly also those reporting under IFRS since for these entities there is no an so specific standard.

Foreign Exchange Issues

In my recent work in spanish language ”Multiple Exchange Rates in Venezuela - An Accounting Problem” (click here to read it), I explained the current situation affecting all Venezuelan entities, but I didn't refer to the translation of financial statements into a foreign currency issue. It is mandatory to summarize the exchange rate environment to understand the origin of the problem here studied.

To date, there are the following legal exchange rate systems in Venezuela:

1. CADIVI (CENCOEX today) Fixed Exchange Rate – Bs6.30/US$1;

2. SICAD I Variable Exchange Rate – Bs10/US$1; and

3. SICAD II Variable Exchange Rate – Bs50/US$1.

1. CADIVI (CENCOEX today) Fixed Exchange Rate

This system is only available to individuals and/or entities receiving Authorization for Settlement of Foreign Exchange (ALD’s) which CADIVI grants at the fixed preferential exchange of Bs6.30/US$1. In April 2014, CENCOEX replaced CADIVI as the office responsible for managing foreign exchange issues. From the date of such substitution, entities entitled to receive ALD from CENCOEX, should be engaged in the importation of essential goods and services. ALD would be subsequently liquidated by the BCV of Venezuela (BCV) at the official preferred exchange rate, so that the entity can demand its suppliers to complete orders based on that premise. As it is known at present, very few entities are receiving foreign currency under this system.

2. SICAD I Variable Exchange Rate – Bs10/US$1

This new exchange system was organized in the first quarter of 2013 and would grant corporations and individuals with a higher exchange rate than the old CADIVI fixed rate, but its value is determined by auctions organized by CENCOEX with the collaboration of BCV. This system would benefit some importers who previously received CADIVI currency at the fixed exchange rate of that system. According to legal terms, entities and individuals registered in the auctions would receive foreign currency at the variable exchange rate decided by BCV, after they make advanced payment of their positions before the auctions. Therefore, entities benefited by this system get foreign currency only for payment of imports and/or services, and BCV is responsible for delivering the currency once the process is complete.

The last known exchange rate of SICAD I, published by BCV on April 7th, 2014 was Bs10/US1. That amount was posted in BCV web page without providing any other detail, and appears to be the result from an average of awards approved in several completed auctions in one day. It should be noted that this rate is constantly fluctuating and entities must plan in advance for purchasing foreign currency, but the final outcome depends on the decisions of BCV at the time of the award. Taking into account what has been published in the press, CENCOEX would be using this system to deliver currencies that were not fulfilled by CADIVI; for payment of new imports of non-essential goods and services; and for other purposes.

3. SICAD II Variable Exchange Rate – Bs50/US$1

This is the latest exchange system introduced after the enforcement of the Law of the Exchange Rate System and its Illicit Issues. This system is different to SICAD I and the exchange rate is set from offerings of individuals and corporations interested in buying or selling foreign currency through BCV. It is not a full-fledged auction and the value of foreign currency is determined on the basis of the tenders submitted to BCV and decisions made under their control. The final, averaged exchange rate published by the BCV as a result of these transactions is higher than SICAD I.

The last known exchange change of SICAD II, published by BCV on May 20, 2014, was Bs49,99/US$1. As with SICAD I, that amount was issued without giving additional details and appears to be the result from the average value of selected deals to buy and sell currencies in one day. In these journeys, those who buy and those who sell present their offers or requests for foreign currency and the prices at which they are willing to settle it. Then, BCV decides who and who cannot participate. Each entity interested in offering or purchasing foreign currency through this system must send it through a bank and await for the outcome of the BCV decisions. Based on these decisions, purchasing entities know the exact exchange rate at which they acquire foreign currency and that is the value they will use to measure the correspondent foreign currency asset.

Payment of Dividends

To date there is no clear evidence that local subsidiaries of foreign entities may remit dividends using any of the three above mentioned systems. The remittance of dividends is legally covered under the Exchange Agreement No. 1 of February 2003, which in part provides:

Article 29. To acquire foreign currency for the remittance of dividends, capital gains and interest, if applicable, as a result of foreign direct investment, as well as.....

The Authorization for Purchasing of Foreign Currency must be requested by the concerned duly registered with the competent national body office. CADIVI will provide its determination to fulfill this process expeditiously.

Applications filed by interested entities, had somehow been processed by CADIVI, and since 2003 these entities had been receiving foreign currency at the exchange rates existing under the regime of then existing exchange agreements. The latest news addressing this issue is from March 7, 2012 and reports, regarding the delivering of foreign currency during 2011, the following information:

“Official figures released by the Report and Accounts of the Ministry of Planning and Finance reveal that only 45 applications were approved related to repatriation of dividends.

A total of 13 companies in the industrial sector have benefited from a greater amount in currency adopted by 31 million dollars, followed by 11 companies in the business area to which they are settled in the amount of US$25,7 million and 2 companies in the sector food with US$13,2 million. Seven companies in the banking area, health and telecommunications were authorized a total of US$11,6 million.”

Source: http://www.elmundo.com.ve/noticias/economia/politicas-publicas/cadivi-aprobo-US$81,9-millones-para-repatriar-divide.aspx#ixzz32IGRFHnO

Since then (probably since 2011), the entities which submitted new applications to pay dividends have not received responses from CADIVI (CENCOEX today) and it is unknown whether that agency will do it at some point. The fact is: there is no guarantee that such requests will be processed and less, which exchange rate, if any, would be granted being it positively decided. Additionally, with the recent elimination of CADIVI, questions have arisen regarding how applications of foreign currency for payment of dividends will be conducted and, also, how the requests made by entities will finally be resolved. One of the institutions grouping multinational companies in Venezuela revealed the following in a press release dated April 8, 2014:

“The commercial debt of companies affiliated within the Venezuelan-American Chamber of Commerce and Industry (Venamcham) amounts to 13 billion dollars, said CEO Carlos Tejera.

He explained that is required a dialogue between the government and industry in regard to the limitations that have arisen in the supply of foreign currency, is required. He affirmed that Venamcham estimated at 10 billion dollars repatriation of dividends by affiliated companies. He recalled that the camera has 1,054 member companies (74% are Venezuelan, 15% U.S. and 11% from different countries), reported El Universal.”

Summarizing, up to date it is not possible to assert which is the applicable dividend remission exchange rate, which would be the applicable rate by US GAAP reporting entities, if strictly they aim to adhere to the provisions of paragraph 45.6 of Section 830.30.

The same does not apply to entities reporting under IFRS since these rules do not contain a provision on a dividend exchange rate and because IAS 21 mandate to using the closing exchange rate. In Venezuela it is very difficult to establish which is the closing exchange rate as we have seen that there are at least three different systems (apart from the parallel rate) whereby entities could buy foreign currency. It could be strongly argued that corporations have no chance of receiving foreign currency under the CADIVI - CENCOEX system (Bs6.30/US$1). That leaves the possibilities of SICAD I and II SICAD, and the parallel rate. According to information from the Internet, the parallel exchange rate at the date of this article was approximately Bs69.50/US$1.

Through different information in the Internet, it has been known that several audit firms of Venezuelan subsidiaries of USA corporations are recommending (some with discretion) that the exchange rate to be applied instead of the dividend remittance exchange rate, should be that of SICAD I because there is a provision in the Exchange Agreement No. 25 of January 2014, supplemented by Providence CADIVI No. 056, which would support that position.

Article 1 of Exchange Agreement No. 25 provides as follows (underlines mine):

Article 1 -. Starting from the effective date of this Exchange Agreement, the settlement of transactions for sale of foreign currency for the concepts below, governed by the relevant rules of the system of administration of foreign currency, will be made to rate resulting from the latest foreign exchange allocation through Supplementary on Foreign Exchange Administration System (SICAD I), which will be published on the website of the Institute:

........

f) International investments and royalty payments, use and exploitation of patents, trademarks, licenses and franchises, as well as technology import contracts and technical assistance.

In turn, Providence CADIVI No. 056 of August 2004 (apparently not superseded), which is applied to implement the provisions of Exchange Agreement No. 25, states the following (underlines mine):

Article 1. This Providence sets out rules for the authorization to purchase foreign currency required to honor commitments under international investment activities in the Bolivarian Republic of Venezuela by companies duly incorporated or domiciled in the country, who are receiving of such investments.

Article 2. The foreign exchange authorized by the Administration Commission (CADIVI) in accordance with the provisions of this Providence only is affected for the following purposes:

......

c) Remittance of profits, rents, interest and dividends from international investment.

So the decision to apply the exchange rate of SICAD I would be sufficiently justified if we attach to the above commented. If it would be so simple, why, then, some of the entities mentioned in the first section have indicated that they would use the exchange rate of SICAD II and another entity informs that they will continue to applying the exchange rate of CADIVI (CENCOEX today)? The answer is frankly: because there is no sufficient, legal or institutional confidence to assure that it is logical to apply the SICAD I exchange rate; but it is less fortunate, in my opinion, to continue in the position of the last and extremely conservative to apply the SICAD II exchange rate. In either case, the problem is not easy to solve because it doesn’t depend on accounting or legal evaluations; because it depends on the Venezuela national executive disposition to comply with their commitments; because it depends on what should be interpreted in the current circumstances on the legality of the laws and resolutions of CADIVI (CENCOEX today). In short, for many other reasons different than those resulting from a purely accounting evaluation.

In other words, the problem will not be resolved by applying accounting standards to a situation that has become an institutional problem, a political problem, a problem of lack of foreign currency, a problem of unwillingness to meet its commitments by the Venezuelan government. Foreign entities, meanwhile, do not risk the reporting of exaggerated losses if they can use an exchange rate even though it is not sufficiently supported. Apparently, their approach to a final decision is not to deny the possibility that someday they could pay dividends or repatriate their investments in Venezuela. Possibly they would have no choice but to do it with SICAD II exchange rate or to go to the parallel market to acquire the necessary foreign currency, either for payments of dividends or for repatriation of their investments in Venezuela. The cost of the decision is bigger than ever.

Conclusion

The lack of reliable information and the lack of legal certainty in relation to exchange events in Venezuela have created a problem for national entities translating its financial statements to a foreign currency that is not really an accounting problem. But, also, it is not a legal issue, as some have asserted.

As I have shown in this article, the accounting principles contain all provisions to handle this matter since long time ago. Obviously, subsidiaries of USA companies (US GAAP) confront the lack of clear information regarding the exchange rate for the payment of dividends, but subsidiaries of other countries (IFRS) are also facing a similar situation because they cannot decide what the closing exchange rate is. In a nutshell, all foreign entities are in the same conditions regardless of the accounting framework that regulates it.

Some readers may argue that in Venezuela there has not been a formal devaluation and, therefore, foreign entities should not apply a rate different from that of the CADIVI (CENCOEX) exchange rate system. That statement cannot be refuted from a legal point of view because, in fact, there is no official devaluation. Others may argue that although there is no official devaluation, all signals sent by the Venezuelan government (SICAD I and SICAD II exchange systems) indicate that devaluation, in fact, has already been implemented but it´s not yet “legalized”. Most radicals justify the devaluation commenting that in the near future there will be only a legal exchange rate close to the parallel exchange rate, because the lack of international reserves and the decreasing of the income from sales of the oil industry.

If we are to believe the latest news, which are based on statements by leading representatives of the national government, the country is heading towards a single exchange rate system by the removal of all of the existing exchange rates and by the implementation of a new unique system close to the parallel market. However, these statements may be pondered as ”interested statements”, who knows for what purposes.

In any case, the accounting effects of all this matter will be of great impact. Devaluation representing three current exchange rates relative to the CADIVI (CENCOEX) rate can be seen in the table below and could be used to compute the amount of potential losses:

Exchange

System |

Exchange

Rate |

Implicit Devaluation

|

CADIVI (CENCOEX)

|

6.30

|

NA

|

SICAD I

|

10.00

|

58.73%

|

SICAD II

|

50.00

|

693.65%

|

Parallel rate

|

69.50

|

1,103.17%

|

The entities that already apply rate SICAD I have anticipated some of the effects of these losses. Those applying SICAD II, if any has actually taken that step, seem more realistic although it is possible that the effect of losses in the financial statements of the parent company may be immaterial. But entities sticking to the CADIVI (CENCOEX) exchange rate are simply delaying, wrongly in my opinion, and without accounting supports, the recognition of true losses. This could be contested or challenged by any interested third party.

Accounting principles contains key provisions to guide accountants in their application and users in their review of the financial statements. The IFRS Framework provides:

QC12 Financial reports represent economic phenomena in words and numbers. To be useful, financial information must not only represent relevant phenomena, but it must also faithfully represent the phenomena that it purports to represent. To be a perfectly faithful representation, a depiction would have three characteristics. It would be complete, neutral and free from error. Of course, perfection is seldom, if ever, achievable. The Board’s objective is to maximize those qualities to the extent possible

QC13 A complete depiction includes all information necessary for a user to understand the phenomenon being depicted, including all necessary descriptions and explanations.........

QC14 A neutral depiction is without bias in the selection or presentation of financial information.........

QC15 Faithful representation does not mean accurate in all respects. Free from error means there are no errors or omissions in the description of the phenomenon, and the process used to produce the reported information has been selected and applied with no errors in the process......

4.38 An item that meets the definition of an element should be recognized if:

(a) it is probable that any future economic benefit associated with the item will flow to or from the entity; and

(b) the item has a cost or value that can be measured with reliability.

Facts and conditions are known. The accounting decisions must be based on facts and convictions. Corporations should consult their auditors, lawyers and other financial and economic advisors to adequately support any decision. The more time goes by without these decisions are taken, the greater and deeper the consequences will be for all those involved.

[1] Venezuela is considered a hyperinflationary economy is from August 2009.

[2] Very few corporations in Venezuela may consider its functional currency is not the bolivar. The best known is PDVSA, for its own special conditions.

[3] Entities may receive foreign currency if they comply with Exchange Rate Agreements for imports of goods and services. If that is the case, they use the official exchange rate for recording of the transactions. There is no a free open market exchange rate.

[4] The remeasurement process is performed by first applying to the financial statements the Inflation Adjustment and then translating it into the reporting currency. If the entities do not adjust for inflation its financial statements will not complying with accounting principles.

[5] This is the reason why the problem occurs.

================================================================================

For more and recent information, see this article in New York Times of July 8, 2014:

--------------------------------------------------------------------------------------------------------------------------

This is a translation of the original work in the Spanish language titled "Las Pérdidas por Conversión de Estados Financieros en Venezuela" published in this Blog in May 23, 2014.

--------------------------------------------------------------------------------------------------------------------------

--------------------------------------------------------------------------------------------------------------------------

No hay comentarios.:

Publicar un comentario

Gracias por su comentario o por su pregunta. Si lo prefiere, envíe un correo electrónico a jdsmartinez@gmail.com y con gusto responderé sus inquietudes. Saludos,